Community Impact

Home » Community Impact

Our Commitment to Community Resilience

For more than 30 years, CORE Tax Deeds and its founder, John Berlet, have operated with a clear mission: convert tax-distressed, vacant and non-homestead properties into productive community assets without displacing anyone. Throughout CORE’s history, no occupied property has ever been acquired, and our strict due-diligence process ensures that continues. Every purchase is verified as vacant through title research, lien reviews, occupancy checks, and physical inspections.

This responsible investment model helps restore local revenue, prevent property deterioration, and return unused land to beneficial use.

Turning Tax Distress into Community Resilience Without Displacing Families

CORE Tax Deeds channels private capital to help Texas counties recover critical tax revenue faster, prevent property blight by stewarding distressed parcels, and operate responsibly under strict non displacement standards.

We also support foreclosure prevention by pledging 2% of fund profits to the NTLA Foundation, helping seniors and veterans remain in their homes.

Our No Displacement Pledge

CORE Tax Deeds adheres to a strict policy of purchasing only non-homestead, vacant, or abandoned properties. In the rare cases where a structure exists, vacancy is confirmed prior to acquisition.

This pledge ensures: No residents are displaced – No occupied homes are targeted, All acquisitions support neighborhood stability – Our investment practices align with our ethical commitments. This approach is central to our model and reflects our long standing belief that tax deed investing should strengthen not disrupt communities.

Supporting Homeowners Through the NTLA Foundation

A core part of our mission is supporting organizations that help vulnerable homeowners avoid tax foreclosure. CORE Tax Deeds proudly pledges 2% of fund profits to the NTLA Foundation, a national nonprofit dedicated to foreclosure-prevention assistance for seniors, veterans, and families in need.

Recognition From the NTLA Foundation

We recently received a formal letter of gratitude from the NTLA Foundation acknowledging CORE’s ongoing financial support.

Their letter recognizes how contributions like ours help expand programs that: Assist seniors and veterans facing tax-related hardship.

Provide resources to help homeowners remain in their properties Support charitable partners such as Habitat for Humanity and Rebuilding Together Strengthen local communities through stabilization efforts

Supporting Foreclosure Prevention

CORE pledges 2% of fund profits to the NTLA Foundation, which helps seniors and veterans avoid losing their homes to tax foreclosure. This ensures our work contributes back to the very communities we serve.

Community Impact in Practice

- 0 instances of displacement in more than 30 years of operations

- Consistent support for tax foreclosure prevention efforts through the NTLA Foundation

- Commitment of 2% of fund profits pledged to support vulnerable homeowners

- Strict vacancy verification before every acquisition

- Two profitable quarters of distributions in 2025, with a third scheduled demonstrating stable operational execution under CPA-reviewed reporting

This work is a continuation of our long-standing belief that investment and community support can and should coexist.

Investment Strategy That Prioritizes

Community Impact

Our investment activity is designed to benefit both investors and local communities by focusing on:

Vacant & Non-Homestead Properties

We target parcels that have been abandoned or unused never occupied residences.

Restoring Local Revenue

When we acquire tax-distressed properties, counties, cities, and school districts receive critical funds that would otherwise remain unpaid.

Preventing Blight

Vacant parcels can deteriorate over time. By securing, maintaining, and eventually returning these assets to the market, we help protect neighborhood value.

Partnership With National Leaders

Our relationship with the NTLA Foundation reflects our alignment with national best practices for ethical and responsible tax deed investing.

Commitment to Tertiary Markets

We focus on underserved counties where our impact can be most meaningful

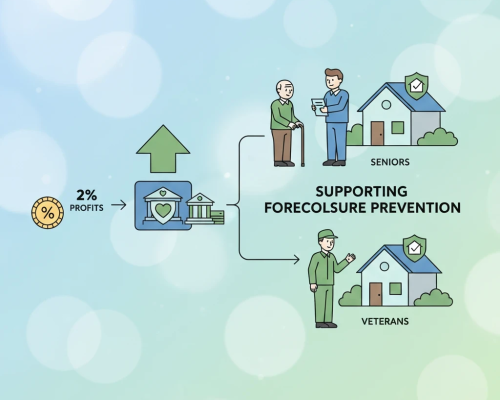

Our Service Areas

While major metropolitan areas often attract the bulk of investment activity, many smaller counties and rural communities face limited access to capital and development resources. These tertiary markets are where CORE Tax Deeds delivers its greatest impact.

By focusing on these underserved areas, we can acquire quality properties at significant discounts while helping address pressing community needs. These markets often offer reduced competition, attractive potential returns, and the ability to make a tangible difference in places that traditional investors frequently overlook.

Concentrating our efforts in tertiary markets creates a dual benefit maximizing potential investor returns while strengthening local economies. Each property acquired represents not only a financial opportunity but also a chance to enhance the quality of life in communities that can benefit most from renewed investment.