Invest in Texas Tax Deeds with a Fund That Does the Work for You.

CORE Tax Deeds is a Texas-based real estate investment fund that pools capital from investors to purchase tax-delinquent properties (tax deed foreclosures) and resell them for profit.

Our Crowdfunding (Reg CF) offer has been extended.

CORE Tax Deeds investment is open to non-accredited investors under SEC Regulation through Silicon Prairie.

View the investment portal here. Contact us for details here.

Experienced Leadership

Strong Track Record

Non-Homestead Properties

Redemption Period For Flexibility

Reliable Deals With The Potential To Yield Returns

Offering Timeline Update

This Regulation CF offering is currently scheduled to close on 28 February 2026 .

Offering details available on the official investment portal. Terms subject to change.

ABOUT CORE Tax Deeds

An Authority on Tax Deeds Investing.

CORE Tax Deeds is an organization that is committed and dedicated to helping others take control of their financial future through tax deed investing. With over 30 years of experience, John is an authority on creating wealth through the little-known strategy of investing in Tax Deed Properties, which allows us to acquire valuable real estate for approximately 30% of market value.

Disclaimer:: Not intended to be legal or tax advice; consult with tax, legal, and financial advisors before you make any investment.

Low

Minimum Investment

Potential

Passive Income

No

Stock Market

Roller Coaster

WHAT WE OFFER

What are Tax Deed Investments?

Uncover the Potential of Tax Deed Investing with CORE Tax Deeds.

How Tax Deed Investments Work

- 6-Month Redemption Period Per Texas Statute on Non-Homestead Properties

- We Get Paid All of our Purchase Amount Plus 25% Penalty if Redeemed in the First 6 months

- 25% penalty if redeemed in week one or month 5. Equivalent to a 50% first-year yield.

Our Niche

- CORE Tax Deeds Focus: Land and Commercial Structures in Texas

- Mineral Interest

- We have Never Bought an occupied property

Risks and Due Diligence

- Avoiding Common Risks - Bankruptcy, IRS Liens, and Environmental Issues

OUR VISION

Learn how tax deed investing works and what role it may play in your financial planning.

We envision a world where individuals can potentially achieve financial freedom through the power of investing in Tax Deed Properties in Texas. Our mission is to empower people to take more control of their financial futures, and tax deed investing is a strong pathway to reach this goal.

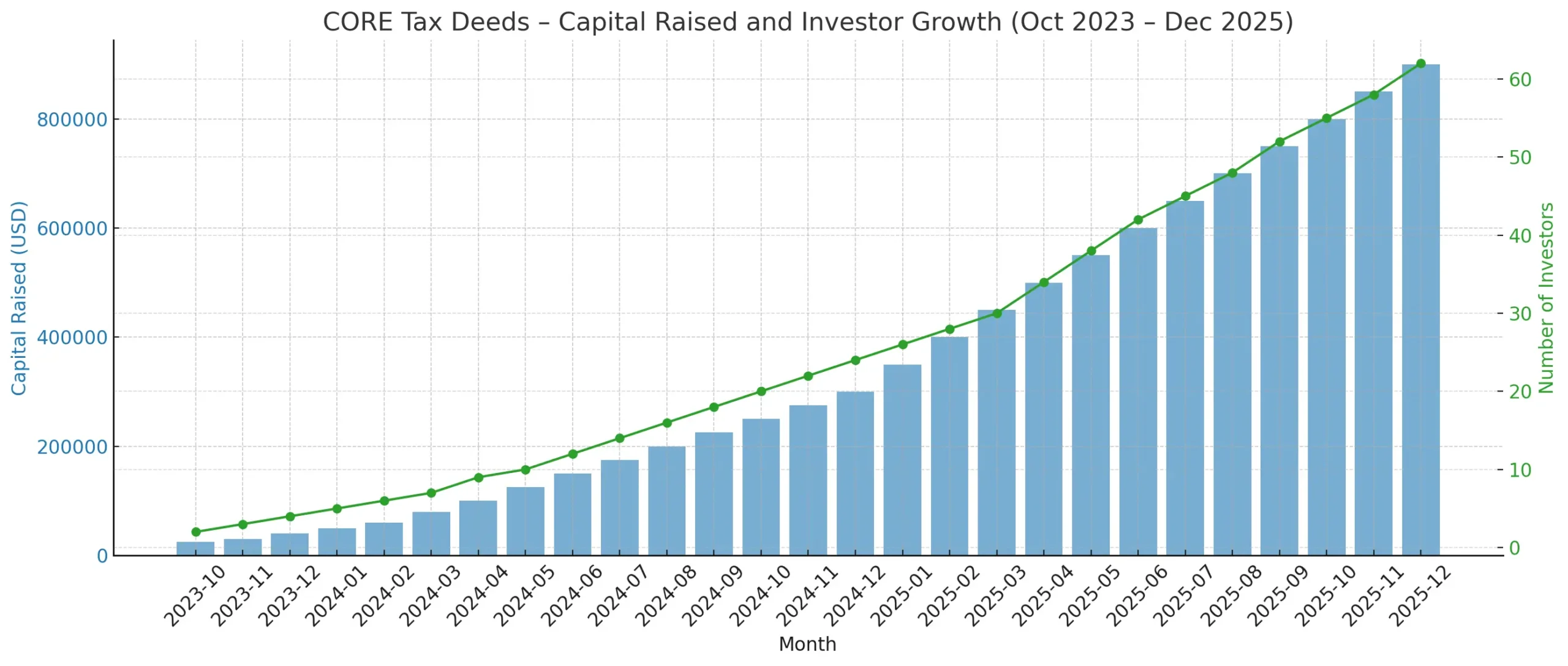

Capital Raised & Investor Growth

The chart below is a sample preview of how performance information may appear on the CORE Tax Deeds homepage. This placement visually supports the existing ‘Experienced Leadership / Strong Track Record’ section. This sample is for internal review only and does not represent a finalized design.

Past results do not guarantee future performance. For information about the current Regulation CF offering, please visit invest.coretaxdeeds.com

FAQ's

Tax deed investing involves buying properties sold by counties for unpaid taxes. CORE pools investor funds to acquire vacant and non-homestead properties in Texas at auction, then manages or resells them.

No thanks to Regulation Crowdfunding (Reg CF), almost anyone can invest.

All investments are made securely through our portal: invest.coretaxdeeds.com .

Yes, retirement funds may be used. Please confirm with your tax or financial advisor.

Texas tax deeds carry statutory redemption penalties of 25% to 50%, but returns vary by property. Past results don’t guarantee future performance.

No. As with all investments, returns are not guaranteed.

Risks include title issues, property condition, resale delays, and market changes. CORE manages these with inspections, lien checks, and due diligence.

CORE targets vacant land, infill lots, and commercial parcels after research and inspections.

Primarily vacant land, small acreage, infill lots, and commercial parcels.

They are secured, insured, and prepared for resale or monetization.

Yes. The offering is conducted under SEC Regulation Crowdfunding (Reg CF).

They are available on the SEC website here and on our portal: invest.coretaxdeeds.com .

Word Of Mouth

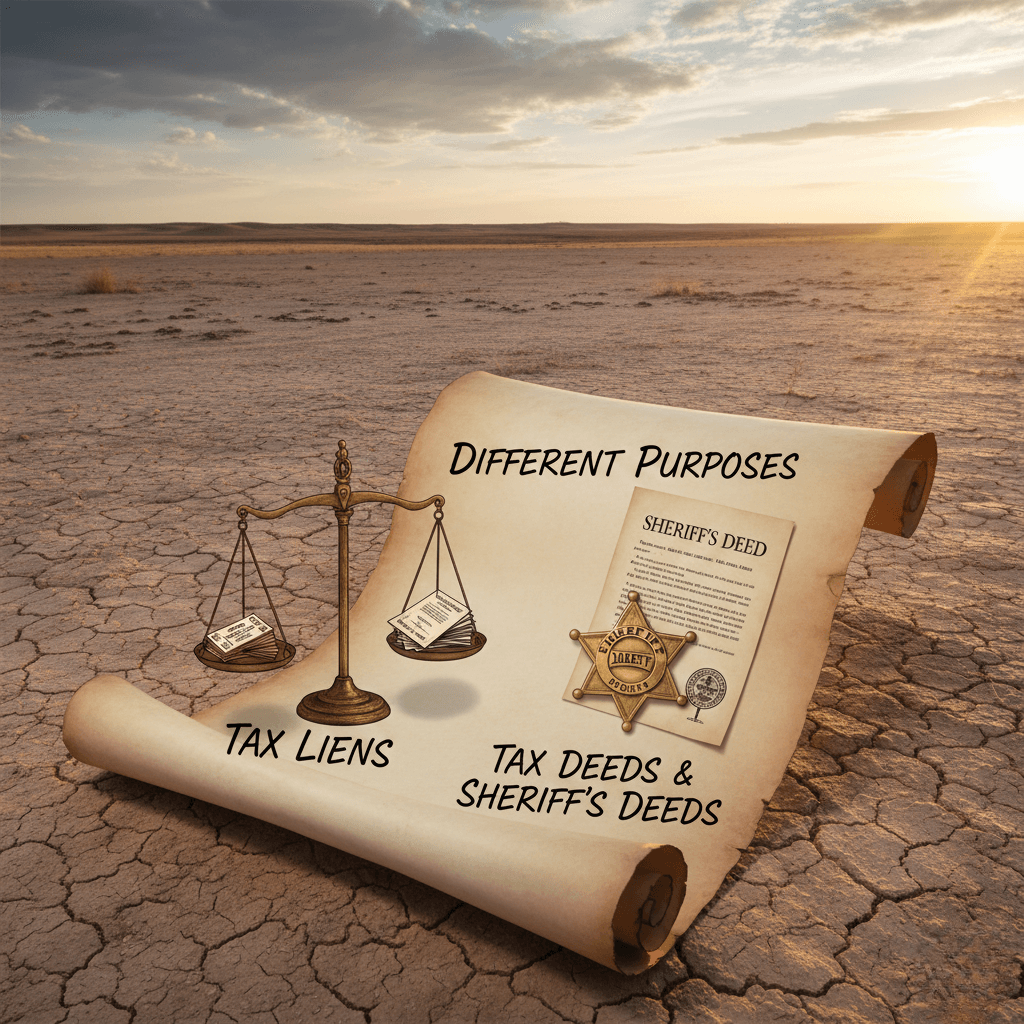

Benefits of Tax Deed Investing

Low Acquisition Cost

Tax deed properties are often sold at significantly lower prices than traditional real estate purchases.

Sheriff’s Deed

When you acquire a tax deed property, you typically receive a Sheriff’s Deed. This deed transfers ownership but without any warranties.

Potential for High Returns

Choosing suitable properties and strategies can offer potential returns due to lower acquisition costs. We are firm believers that you make your profit when you buy right at the right location.

Diverse Investment Portfolio

Investing in real estate tax deed properties allows you to diversify your investment portfolio.

Control over Investment

When you invest in tax deed properties, you have greater control over the property's fate.

Local Economic Benefits

Investing in tax deed properties can contribute to the revitalization of local communities. Brings much- needed delinquent tax revenues into cities, counties, and school districts.

Contact Us Today

READ OUR BLOG

Featured News and Blogs

Core Tax Deeds Charity Policy: Commitment to the NTLA Foundation