How CORE Tax Deeds Protects Investor Capital

When investing in real estate-backed opportunities, one of the most common concerns is capital preservation. At CORE Tax Deeds LLC, we’ve built an infrastructure specifically designed to protect investor capital while unlocking significant upside potential in the Texas tax deed market. In this article, we break down the key safeguards, strategies, and systems that help […]

CORE Tax Deed Property Acquisition: Behind the Scenes

At CORE Tax Deeds LLC, acquiring a property is just the beginning of a disciplined, step-by-step process designed to maximize value and minimize risk. While many investors are familiar with the auction aspect of tax deed investing, few understand the complex and professional process that unfolds after a successful bid. In this article, we walk […]

Thinking About Texas Tax Deeds? Here’s How It Works (And Why It’s Catching On)

Ever wondered what it’d be like to own real estate for pennies on the dollar without being a landlord or flipping houses? That’s the world of tax deed investing, and it’s growing fast, especially in Texas. If you’ve heard of tax deeds but still aren’t totally clear on how it all works (or how you […]

From Crowdfunding to Real Assets: Why Tax Deeds Stand Out in 2025

From Crowdfunding to Real Assets: Why Tax Deeds Stand Out in 2025 In 2025, investors are looking for less stock market volatility and speculative trends and more real assets, real returns, and real strategies they can understand. One of the most compelling options in this new investment landscape is tax deed investing, especially when accessed […]

Thank You for Attending Our MoneyShow 2025 Session

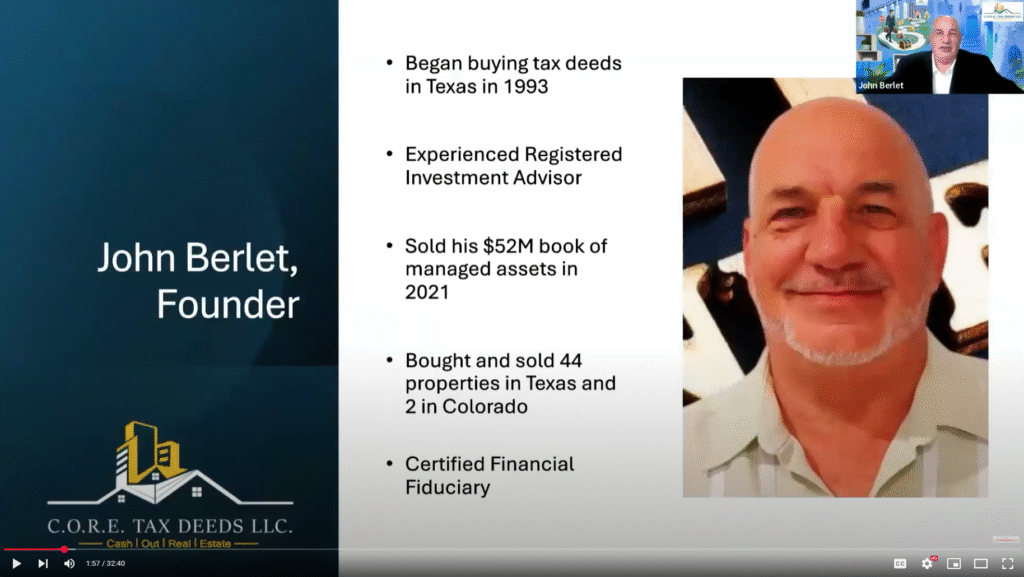

On May 22, 2025, CORE Tax Deeds Founder John Berlet presented “Turning Texas Tax Deeds Into Gold” at the MoneyShow Virtual Expo. We want to extend our sincere thanks to everyone who joined the session, asked thoughtful questions, and showed interest in learning more about this unique investment strategy. What We Covered In his session, […]

Featured on Investor Fuel: John Berlet’s Take on Tax Deeds and Retirement Strategy

When an industry veteran like John Berlet is invited onto the Investor Fuel Real Estate Pros Show, it’s not just a podcast appearance—it’s a signal that something important is happening in real estate investing. In the episode titled “Secret Niche for Effective Retirement Planning with Real Estate Tax Liens,” Berlet shares how CORE Tax Deeds […]

Learn from John Berlet at the MoneyShow Virtual Expo – Turning Texas Tax Deeds into Gold

We’re pleased to announce that John Berlet, founder of CORE Tax Deeds and a recognized authority on tax deed investing, will be presenting at the MoneyShow Virtual Expo, taking place May 21–22, 2025. John’s session, titled “Turning Texas Tax Deeds into Gold,” will take place on Thursday, May 22 at 11:50 a.m. CT. In this […]

Texas Supreme Court Confirms: Severed Mineral Rights Survive Tax Foreclosure Sales

The Texas Supreme Court held that severed mineral interests are not extinguished under the Texas Tax Code when surface property is sold at a tax foreclosure auction. In Bragg v. Edwards, the court ruled that taxing authorities can only foreclose on interests subject to taxation—and severed minerals aren’t taxable separately from the surface unless they’re […]

CORE Tax Deeds Crowd Fund Making Waves in 2025

Surpassing both the number of investors and total capital raised in Q1 alone compared to all of last year, CORE Tax Deeds is experiencing a kind of growth that’s rare in passive real estate investing. It’s a clear signal that investors are recognizing the power of this unique model: real estate-backed returns, no landlord duties, […]

Texas Homeowners Hit Hard by Skyrocketing Property Taxes

The capital gains tax is a levy you pay when you sell an asset that has increased in value since you bought it. Your capital gains tax rate can be 0%, 15%, or 20% depending on your income and your tax filing status. Certain assets are taxed at different rates depending on what they are and the situation.